7 steps to report credit to Equifax, Experian, Innovis and TransUnion

7 Steps to Report Credit to Equifax, Experian, TransUnion, and Innovis

Congratulations! You have made the right decision to report your consumer accounts to the credit bureau(s). This will reward your customers paying on time by opening financial opportunities for them after you report their positive score. At the same time, it may also encourage your delinquent accounts to pay on time.

Usually it takes between 1 and 3 months to get your account established with the credit bureau(s). We will guide you through each step of the process. If you have any questions, just give us a call at (833) 387 7545 or email support@hutchinssystems.net. Let’s start the journey…

Step 1 – Sign up with credit bureau(s) as a data furnisher

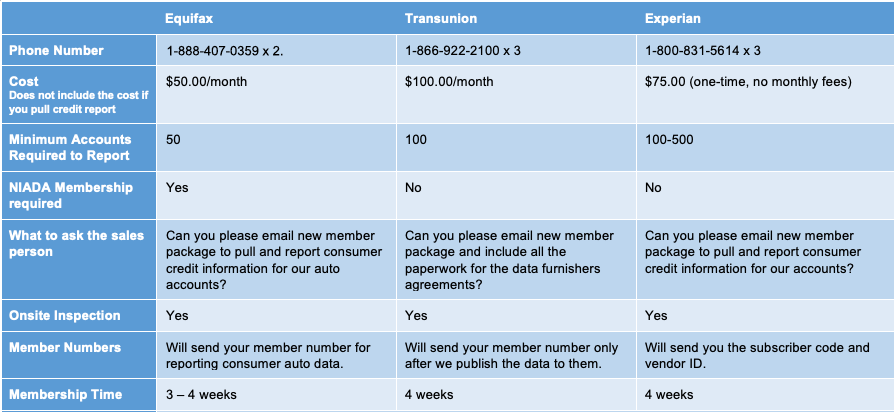

First you should sign up your business as a data furnisher to report the consumer accounts to the credit bureaus. Some useful information and contact numbers of the credit bureaus are below.

First you should sign up your business as a data furnisher to report the consumer accounts to the credit bureaus. Some useful information and contact numbers of the credit bureaus are below.

If you have provided an email to the sales person, Then you will receive all the communications through email. Check your spam folder regularly until you receive your approval to make sure the emails from the bureau(s) are received

Step 2 – Fill in the service agreement very carefully and check again!

The Credentialing Analysts at the Credit Bureau(s) are very busy but also extremely thorough and detailed in their screening and approval process. In order for your business to pass their approval, it’s essential that you provide accurate information about your business. Some items are as follows –

The Credentialing Analysts at the Credit Bureau(s) are very busy but also extremely thorough and detailed in their screening and approval process. In order for your business to pass their approval, it’s essential that you provide accurate information about your business. Some items are as follows –

- Owner name of the business as in the legal business formation document.

- Physical and mailing address of the business in the application should match any source of information like your website, Google. or phone directories.

- Nature/kind of business – explain it in detail. If you buy and sell jewelry, then explicitly mention both parts of the business – Buying and selling jewelry.

- Data processor information section -Here you will need to make 2 important decisions

1. Metro 2® Software – If you are already using a software that can generate Metro 2® format file, you are set! If you need a software to generate Metro 2® format file, call us at (833) 384 7545; we will set you up with Credit Time 2000©. If you are not clear if you need a software, call us.We will help you figure it out!

2. Data Processor – If you would like Hutchins Systems to audit, validate, and process your data to the bureaus each month call us at (833) 387 7545.

3. Based on the decision above you will fill in the data processor section of the agreement –

-

- Metro 2® Software – If you are going to use Credit Time 2000, then enter Credit Time 2000. Otherwise enter the name of the Metro 2® software you are planning to use.

- Processor Information – If using Hutchins Systems, we will provide the information that would go into this section.

- Check if all the required questions are completed; do not skip/miss any questions it will just delay the approval process.

Submit the application, wait… check the application again if you need to. 🙂

As mentioned before, timely response to the questions from credit bureau(s) will speed up the approval process, so check your emails (including spam/junk folder) and respond as quick as you can!

Step 3 – Prepare your business for physical inspection

After you submit your data furnisher application, credit bureau(s) will schedule a physical inspection of your business location. Some common items they would check are below – (change to say are as follows:)

After you submit your data furnisher application, credit bureau(s) will schedule a physical inspection of your business location. Some common items they would check are below – (change to say are as follows:)

- Company’s permanent non-removable signage; it needs to be located on a door, exterior, wall, or window.

- If there is a directory available in your building, make sure your business is listed in it.

- All your consumer files should be held in a secure location such as locked cabinets, here locked file room, or such.

- If you have any computers used in your business, make sure it’s password protected and the screen is locked when not in use to prevent unauthorized access.

- You should have a crosscut or micro-cut shredder to securely dispose of your consumers’ paper documents.

Please be respectful and courteous to the inspector and give him space to do his inspection; any questions he may ask is just to make sure accurate information is being passed to the bureaus.

Now, the waiting continues…

Step 4 – Hurray! Your data furnisher account is approved. THE FIRST data load

You will receive an email or call from a member of the bureau(s) that your data furnisher account is approved, Congratulations!! But wait, there is one more thing you need to do.

You will receive an email or call from a member of the bureau(s) that your data furnisher account is approved, Congratulations!! But wait, there is one more thing you need to do.

You have 30-60 days from approval date to send your first data in Metro 2® format to the bureaus. This first data load you send to the bureaus should be in Metro 2® format. Data that you report should be in compliance with Fair Credit Reporting Act (FCRA) and Fair Credit Billing Act (FCBA). Any data format or data violations will delay the successful loading of your data. If you are uncertain of the accuracy of your data, call us at (833) 387 7545 for a one-time free summary level audit BEFORE sending it to the bureaus.